Our Fees

How (and what) we charge for for financial planning, portfolio management, and educational services.

Hourly Fees for Financial Planning

Financial (and Estate) Planning services are billed on an hourly fee basis. The hourly rate is $250 per hour; billed in 15-minute increments. (This rate is reduced for customers using our Portfolio Management services as shown on the Discount section). Typically, the Firm will provide an estimate of the time required; significant revisions to that estimate will be brought to the client’s attention as soon as possible to prevent unexpected bills. Short phone calls, follow up questions and emails with clarifications are typically not charged an hourly fee. More complex questions, however, that were not contemplated during the original engagement and that will require additional work will only be undertaken after an additional estimate and affirmative instructions from the Client. The Firm does not require a deposit to initiate financial planning engagements; the entire fee is due upon delivery of the invoice. Invoices are typically issued either at the presentation of the plan (or delivery of a document containing the plan or work product). For longer engagements, invoices will be issued on a quarterly basis (in arrears). All fees are negotiable in advance, and for certain projects the Firm may undertake to complete work on a “not-to-exceed” hourly fee basis.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. ”

— Paul Samuelson

Discounts are also available for certain customers as described in the Discounts section.

See Form ADV2 for more.

Contact us for a free consultation

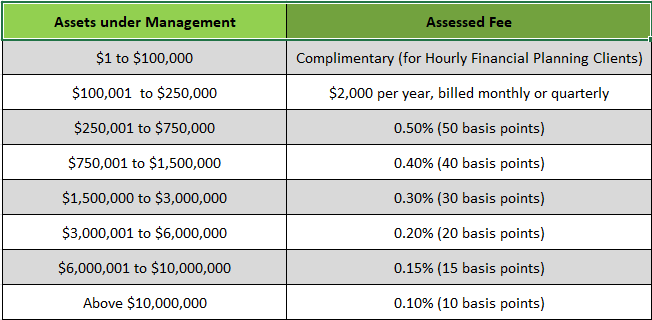

Portfolio Management Fees

The Firm does not require a minimum account size to open and maintain an investment account, nor are there account opening and/or administration fees charged by the Firm to initiate portfolio management services. For the benefit of discounting the asset-based fee, the Firm will aggregate accounts for the same individual and (upon request) those accounts within the same household/family as identified in the engagement agreement. Portfolio management fees are blended - i.e. portfolio amounts in each tier are charged the corresponding fee. All fees are negotiable. See our Form ADV2 for more.

“Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.”

— Seth Klarman

NB: Please also see the Discounts section, for longevity discounts applicable to these portfolio management fees after multiple years of being a client.

Contact us for a free consultation

Fees for Educational Services

Educational services are only available for family members of the Firm’s clients and fees for such services are charged to the client at an hourly rate of $100 per hour, billed in 15-minute increments.

“Experience is the hardest kind of teacher. It gives you the test first and the lesson afterward.”

— Oscar Wilde

Seminars and presentations to groups are complimentary to attendees, although fees of $500 per hour may be charged to workshop or presentation sponsors (depending on agreed-upon focus and extent of workshop). Certain non-profit sponsors may be eligible to have their fee waived. All fees are due at the end of the last session (for educational services) or the completion of the seminar/presentation (i.e. both charged in arrears).

Each time the Firm charges a fee, the Firm will send the Client a written invoice, including the fee, the formula used to calculate the fee, the fee calculation itself, the time period covered by the fee. All fees are negotiable. See Form ADV2 for more.

Contact us for a free consultation

Discounts

Long Relationships

The firm values long and collaborative relationships, and believes our clients should enjoy a financial benefit from the expertise we have gained over the long time spent working with you. Accordingly, we offer discounts on portfolio management asset-based fees of:

“Cash rules everything around me.

C.R.E.A.M., get the money.

Dollar Dollar bill, y’all.”

— Wu-Tang Clan

“Ain’t no money in poetry;

That’s what sets the poet free;

And I’ve had all the freedom I can stand....”

— Guy Clark

- 10% after three years;

- 20% after seven years;

- 30% after 15 years of being a client.Clients who use us for Portfolio Management also enjoy reduced hourly financial planning fees, with further reductions applicable as assets subject to the asset-based fees increase:

- $100,001-$250,000: $100/hr

- $250,001-$750,000: $75/hr

- $750,001-$3,000,000: $50/hr

- Over $3,000,000: complimentary, with rare exceptions to be agreed in advance.

Island Residents and Veterans

I love living on Vashon and our Veterans have protected the waters of Puget Sound since the Pig War of 1859, so the firm offers a discount of $250 dollars off per year, applied as a $50 per hour discount on hourly fees (or on the final quarterly bill for portfolio management clients) for:

- Residents (denoted by billing address) of Vashon Island, Bainbridge Island, and the San Juans (residents of Mercer “Island” should be happy they aren’t subject to a 3X surcharge!);

- U.S. Veterans and US Department of Veteran Affairs Employees.

Just Getting Started

It’s important to get off on the right foot financially, and at the same time, my partner and I remember having to repay more than $500,000 of law school and medical school loans. Accordingly, we offer a discount of $500 off per year, applied as a $50 per hour discount on hourly fees (or on the final quarterly bill of portfolio management clients) for:

- Medical professionals in medical school, residency, fellowships, or within three years following completion of their degree program (e.g. Nursing School, Physician's Assistant School), and

- Lawyers within three years of completion of JD (or LLM), excluding years spent clerking.

Note: All discounts stack, so feel free to move to Vashon (+$250 in discounts), go serve in the U.S. military (+$250 in discounts), and then work for the VA (+$250 in discounts) as soon as you finish your residency program (+500 in discounts). And, of course, remain a customer for 15 years!